Following its release of the Main Street Lending (MSL) program three weeks ago, the Federal Reserve has issued more detail on guidance, answered Frequently Asked Questions (FAQs), and made some adjustments to the original scope of the program.

“After listening to the press conference delivered by Fed Chair Powell, and reviewing the FAQs and additional guidance issued by the Federal Reserve, we are happy to confirm that this loan program is friendly with its terms and a viable option for many businesses impacted by COVID-19,” says Clinton Baker, principal at K·Coe Isom.

“While there are some restrictions on the funds, the updated eligibility requirements have just made the MSL program available to a larger proportion of businesses – from those with a single employee, up to 15,000 employees. The new guidance for this program has created an option for businesses that may need to refinance some debt in this process,” he adds.

A major point stressed at the press conference by Fed Chair Powell was that “we won’t run out of money.” Unlike the Paycheck Protection Program (PPP) which quickly exhausted its initial funding and required additional funds to meet demand, while the Federal Reserve has initiated this program as a part of the CARES Act, there are additional resources from the Fed to fund MSL if needed. He added, “It’s not a limited pot.” Fed Chair Powell reiterated the key differences between the two: PPP is a grant program, whereas MSL is a loan program.

Main Street Lending Updates

- Confirmation that this is a lending program (not a grant or forgivable loan program)

- Narrowed the definition of eligible borrower to “businesses” and excluded some industries, but expanded the size of business that can qualify

- More loan options were released, including some refinance options

- Focus remains on ‘2019 EBITDA’ for determining loan amount (which remains a limiting factor for some businesses)

- Additional clarity was provided for the coordination of MSL loans with other debt of the business

New Details of MSL

Redefines eligible borrower:

- Confirms use of PPP and MSL by the same company is allowed

- More narrowly defines “business” to:

- Exclude non-profits, but in the FAQs the Fed recognizes this and will be evaluating making adjustments to the program

- Adopt the SBA list of excluded industries (from SBA guidelines for their programs)

- Increases the size of borrower to either: less than 15,000 employees –or– $5 billion in 2019 annual revenue

- Confirms many other requirements under initial program guidance

Increases number of loan options:

- “New” loan and “Expanded” loan programs are similar to previous guidance, and a “Priority” loan choice has been added

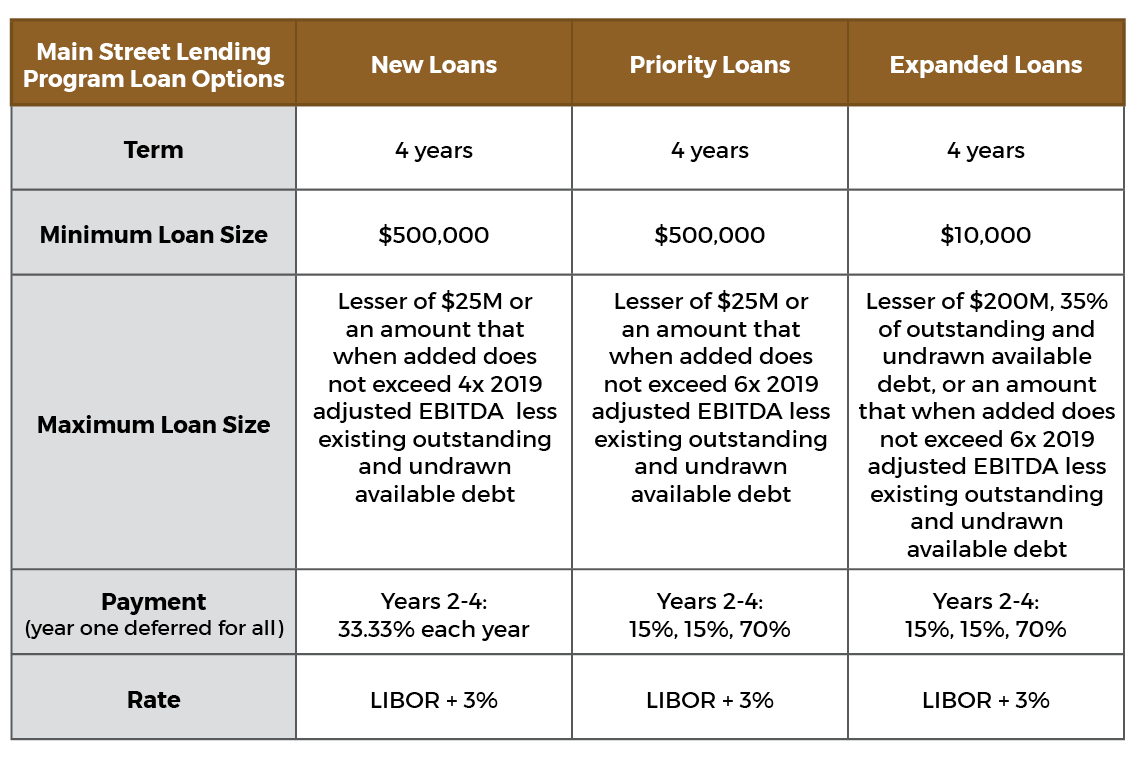

Summary of the Loan Options

Changes to the size of loans:

- Focus is still on 2019 EBITDA, but:

- Lender must certify it follows normal lending practices when relying on EBITDA

- Fed acknowledges this is not customarily used for asset-based borrowers and will be evaluating adjusting the metrics for those borrowers

- Loan minimum was lowered to $500,000

- Maximum loan amount is $25M for New and Priority loans, but $200M for Expansion loans

- These maximums are still limited by the other debt of the borrower as reported in the initial guidance

- Priority loans create another option for ‘6X EBITDA’; also eligible to use to refinance loans with a different lender

Changes to Terms:

- Interest and principal payments deferred for first year (guidance remained the same)

- Interest: changed to 3% over LIBOR (rather than the previous SOFR references)

- Principal:

- New and Expanded loans clarified payments over four years (0% year one, 33% year two, 33% year three, and 33% year four)

- Priority loans create a balloon at the end of payments over four years (0% year one, 15% year two, 15% year three, 70% year four)

Restrictions:

- Capital distributions and dividends related to common stock remain restricted; however, the new guidance now allows distributions from pass-through entities (S Corporations and partnerships) to “reasonable” distributions to pay tax liability related to this entity

- Compensation remains restricted (same as initial guidance)

- Collective Bargaining Agreements and remaining neutral in union organized activities – in the law but not mentioned on original term sheet, new term sheet, or the FAQs

Should you have any questions regarding the eligibility requirements of MSL, or its applicability to your business, contact a K·Coe Isom advisor.

[1] Earnings before interest, taxes, depreciation, and amortization